Bitchslap the Banksters: Trump vs. The Fed

Unpacking the Public Frustration with Federal Reserve Policies

Is there anyone who truly likes the Fed? Does anyone wish the organization well? Does anyone care who the members are or what they do all day? The answer to all of these questions is a resounding NO!

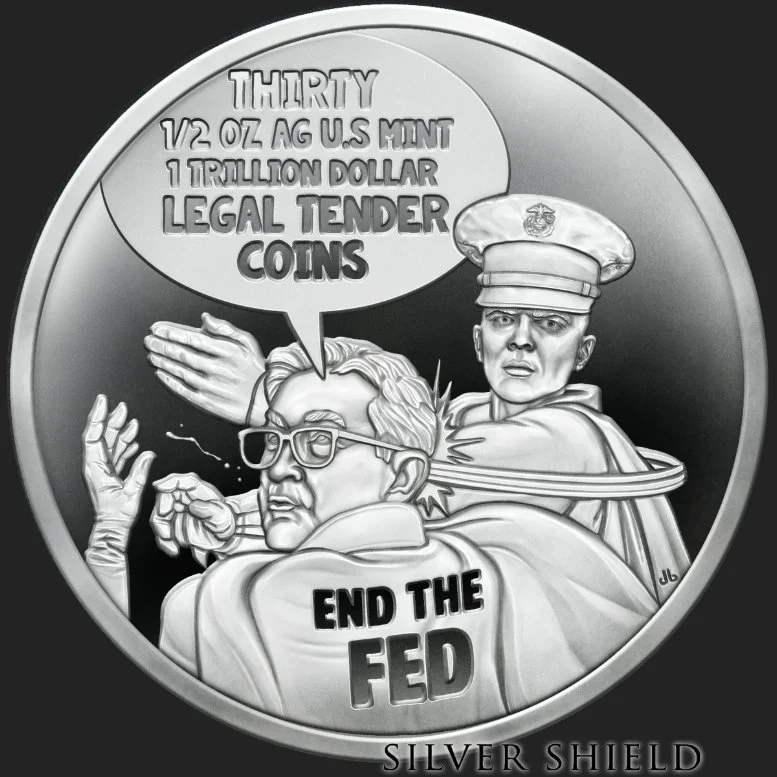

Nobody “likes” the Fed. When people are asked for their opinion of the Fed, nearly all the responses are negative. People’s answers usually run the gamut from disdain to hate, and nearly everyone would agree that those negative responses are justified. Chris's new coin, Bitchslap Bankster, demonstratively illustrates the recent frustration many people feel when confronted with the Fed’s stubbornly high mortgage rates.

The Fed's Public Perception Problem

It doesn’t seem to matter if the economy is doing well or not; the Fed is routinely reviled, mocked, or simply ignored. Most of the time, no one praises their work or applauds their decisions or even acknowledges their existence. The Fed is treated by most people as though it were a worm, an essential component of life, but ugly, slimy, and living in dark places.

Most people don’t really understand the who, what, when, where, or how of the Fed. Most don’t even think about the Fed’s activities until they want to buy a house, or a car, or a boat, and they need a loan from the bank. Then, people become laser-focused on the Fed’s activities because it can mean the difference between buying the home of their dreams or just buying an ok house to live in. Monitoring fluctuating mortgage rates can become a daily chore.

A History of Mortgage Rate Madness

Many people have already taken the mortgage rate roller coaster ride, and plenty of people have taken the ride more than once. When the Greatest Generation was young and buying homes in the 1950s, mortgage rates were around 3%. By the time the Baby Boomers began buying homes in the 1970s, the 30-year, fixed-rate mortgages had jumped to 9%.

For those of you who remember the disastrous economy inflicted on the country by the inept President Carter, insanely high mortgage rates literally drove people to distraction. Rates were rising so fast that many young families were actually glad to have gotten a mortgage rate of 9% in order to build a new house.

But, many of those same people got trapped by the sluggish economy, the bank’s ability to raise their loan rates before closing on the house, and by the resultant year-long delays in construction. When the rates climbed just 1/4 of a percent, to 9 ¼, many new homebuyers were literally pushed to the brink financially. The trickle-down effect of high rates also affected the builders. Many of the builders couldn’t afford the escalating loan rates in order to run their businesses either.

Luckily, the rates for a 30-year, fixed-rate mortgage have continued to drop from the high, during the Carter years, of 16.64% in 1981. The Reagan years saw rates plummet. According to Fannie Mae’s records, during the 1990s, the average was just 6.50%. The 2000s saw the rates drop to 4.70%. The decade of 2010 had an average mortgage rate of just 3.31%. And in January of 2021, during the COVID scare, the rates dropped to an all-time low of just 2.65%.

But, in the last four years, the Fed has significantly raised the rates, jumping to 5.34% in 2022 and 6.81% in 2023, and while it went down slightly in 2024, it has returned to 6.81% in 2025.

Trump vs. Powell on High Rates

Granted, the Biden economy was awful, and the rising rates, during his four years in office, were to be expected. But now with the 2025 economy blooming again, there’s no excuse for a return to the same rate as existed during Biden’s administration.

When you see how well President Trump’s economy is doing, you can understand his frustration with the artificially high rates being inflicted by the Fed. Emblematic of this battle is President Trump’s contentious relationship with the Fed Chairman Jerome Powell. And, Trump is rightfully annoyed at Powell’s refusal to lower rates despite all the good economic news pouring out of DC.

President Trump primarily wants the rates lowered in order to spark the housing market and stimulate the economy further. But, more importantly, he also knows that the interest on our 37 trillion dollar national debt has reached over a trillion dollars a year. So, by reducing the interest rates, and in conjunction with all the other cutbacks and tariffs he’s put in place, he’d have a shot at actually paying down the debt. Despite all of this logic and President Trump having discussed this situation directly with Powell himself, Powell’s refusal continues.

Trump believes that the high interest rates are being weaponized against him for reasons other than those dictated by the economic indicators. Trump has said that Powell is using the artificially high rates to deliberately slow his economic juggernaut and that Powell’s decision to keep them high is based purely on politics. You can learn about how this relates to the wealthy elite in another post.

Would a bitchslap be appropriate under these circumstances?

It’s hard to imagine that President Trump hasn’t considered it.

Maybe a friendly boxing match is in order.

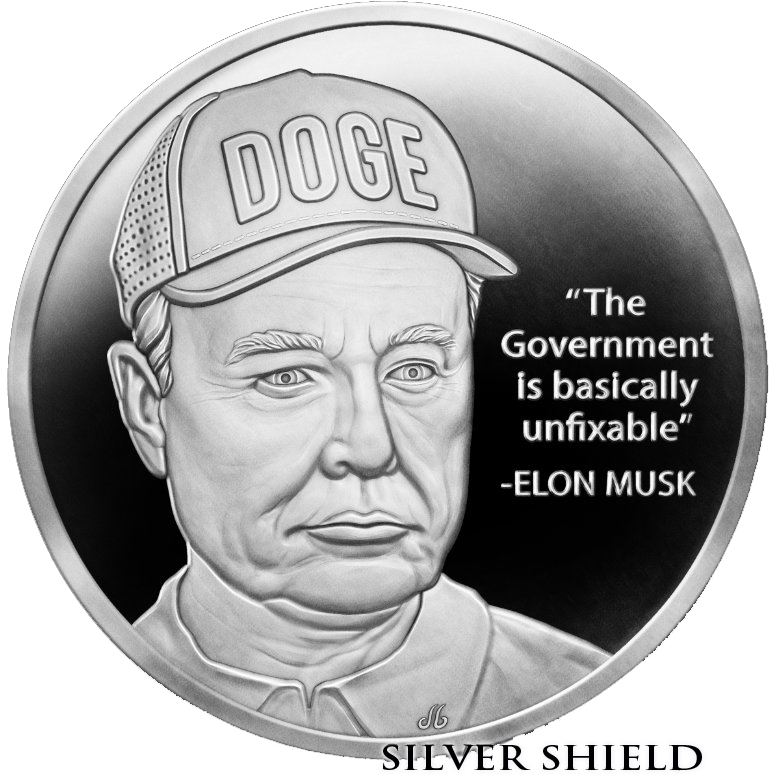

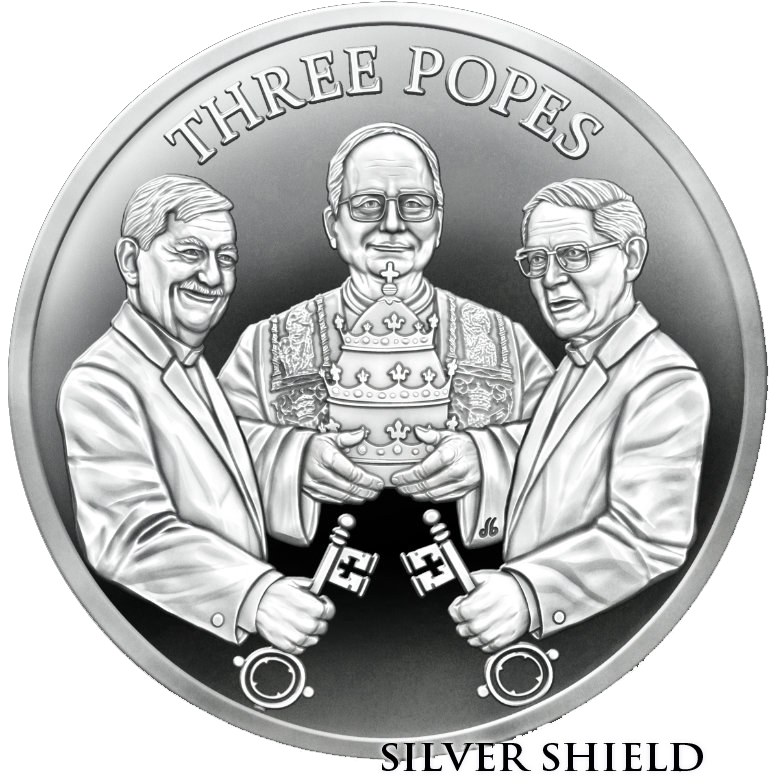

Other 2025 Silver Shield Proof Round releases