Dollar Demon

Dollar Demon: The Silver Shield Warning on Fiat Currency

This week’s Silver Shield public coin from silver coin designer Chris Duane is titled, Dollar Demon. It reflects one of Chris’ defining presuppositions about the underlying threat fiat currencies pose to your financial future.

No one can argue that today’s dollar is still worth what it was in 1940 or 1950 or even 1970. And, although the devaluation of the dollar does not routinely happen overnight, most older Baby Boomers are well aware of the dramatic depreciation of the dollar’s purchasing power that has occurred just during their lifetimes.

Many bought 3 bedroom houses in the 1970s for $30,000. Today, those very same Mid-West houses are selling for $250,000. They are nearly 10 times as expensive as they were back then.

Granted, many now have updated kitchens and bathrooms, but that doesn’t explain their soaring prices.

Even if you look at the cost of housing from the late 1990s, and compare it to today’s prices, it's still startling to see the money it now takes to buy a house. A house purchased for $600,000 in 1994 in the Northeast is now valued at over $5 million today.

Why Housing Became Unaffordable for Younger Buyers

The purchasing power of the dollar has been decimated to the point that many young people can’t even get into the housing market because their incomes can’t cover the expense of purchasing a home. This even applies to couples with dual incomes because many of them are locked out of the housing market as well.

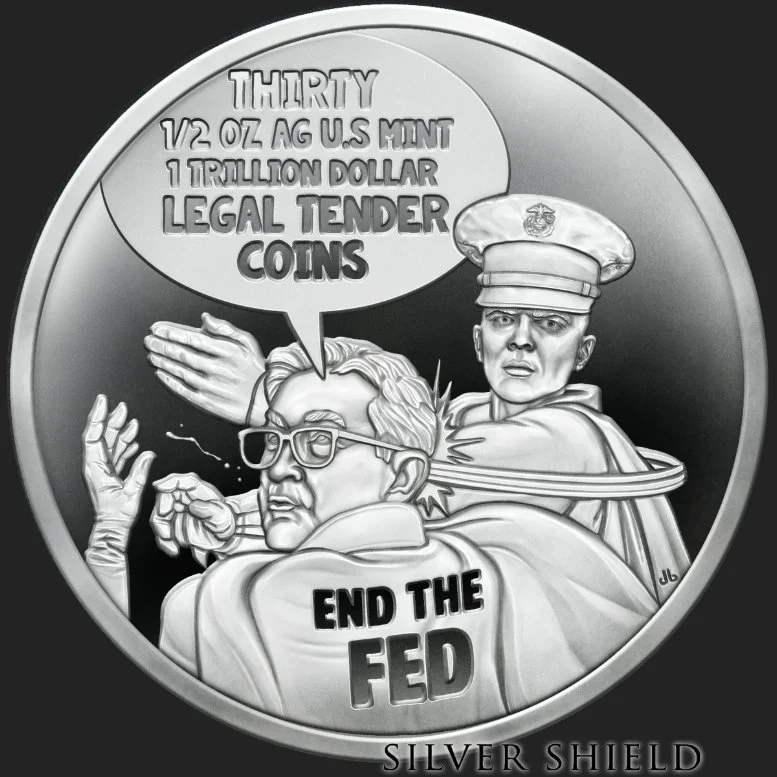

And why are they in this boat? It is because the value of the dollar was destroyed when Pres. Nixon took the country off the gold standard in 1971. And it has been further destroyed by the Fed who began to flood the market with easy money. Unhitched from gold, it cost them nothing to print trillions of dollars of worthless paper.

Easy Money, Rising Debt, and the Inflation Cycle

Although the Fed insists they are in the business of controlling inflation, their track record proves otherwise. The more money they print, the more money is available for institutions, companies and people to borrow, many of whom get drunk on the money available. And, the more people borrow, the higher debt climbs, which then necessitates covering their debts by increasing the prices of goods and services they provide. This is the quintessential definition of inflation.

But, what happens when the music stops. Chris believes the music has stopped and that our national debt of $38 TRILLION has finally reached a flash point. He believes that government implemented inflation is the only exit ramp for the US government. When this happens inflation could reach 300% overnight. In the blink of an eye, the dollar could be devalued to the point of obscurity and with it goes every cash asset you own.

Don’t be fooled by the financial “experts”. Just watch what the silver market has been doing recently. China is hoarding silver and buying whatever it can find for $12 above spot. Be warned, as Chris says, the “Everything Bubble” is about to explode. And, Chris’ new coin, Dollar Demon, vividly shows why the dollar is on very shaky ground.

Why Physical Silver Is a Hedge Against Inflation

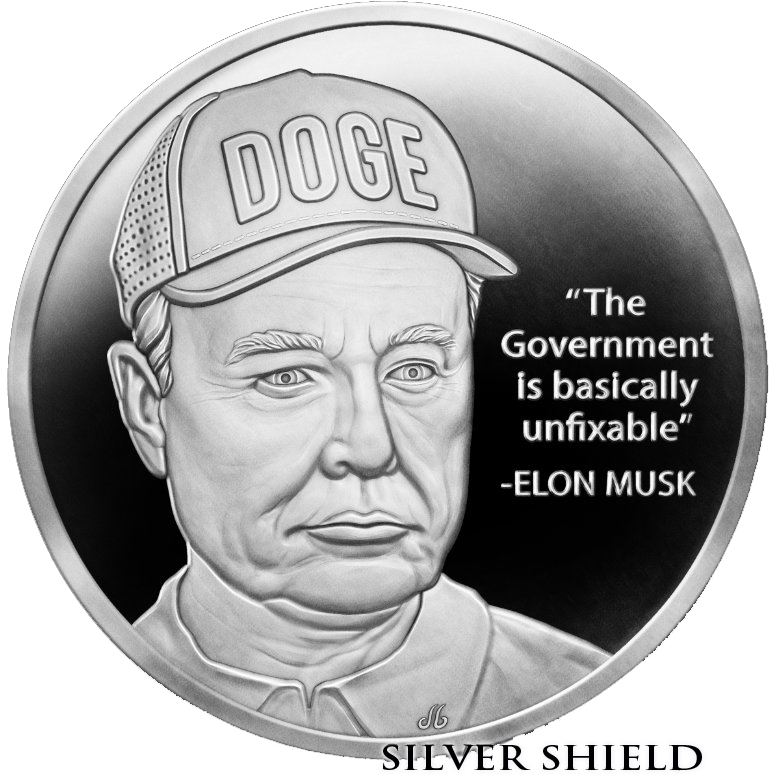

So, once our Commander-in-Chief finishes neutralizing Venezuela, let’s hope he proves Musk’s prognostication wrong. Let’s hope Trump turns his attention once again to neutralizing the US government bureaucracy because it is no less a threat to our citizenry than was Venezuela.

So, if you have not already heeded Chris’ warnings concerning the stability of the dollar, it is not too late to buy physical silver. It is the very best hedge against inflation because it has 10,000 industrial uses and the manufacturing industry, primarily tech, car and solar industries need it to survive.

Despite silver’s rising market price, buy it today because it is the only way to get through this pending disaster as a hero as will watch your investment continue to increase in value as the supply of physical silver diminishes and the demand continues to rise.

Remember, buy physical silver - not ETFs, silver futures or silver stocks, all of which leave your investment at risk because they are "digital illusions of wealth” that can evaporate with the tap of a keyboard.

Savor the peace of mind that comes from owning physical silver and get the silver directly into your hands today!

Other Silver Shield Proof Round releases