Safe in Silver

Why Saving in Silver Offers Real Security in an Uncertain Economy

Nearly all people try to save for the proverbial “rainy day”. Not everyone approaches that task in the same manner. And although there may still be those who stuff their cash under their mattresses or under a loose floorboard or in a cookie jar, most people traditionally use their bank’s direct-deposit option or head over to their local bank to deposit their cash, checks and coins into their savings accounts.

When Saving in Banks Felt Safe

There was a time, during the idyllic 1980s, when savings account rates reached 8%. That was a nice return for millions of baby boomers who were just starting out in life. So, putting your money in the bank not only became a type of investment but it became a habit too.

Many people felt safe knowing they had $1000 in the bank. Some people didn’t feel comfortable until they reached $5000 in savings and there were others who were not happy until they reached $10,000. Much of their reasoning was based on their current income and their future plans.

As pending marriages, home ownership and then children’s education loomed in the future, saving money literally became a second, full-time job. Of course, investing in the flourishing stock market could help, but it was risky and most people weren’t comfortable with the risk involved. So, the majority of people stuck with their local bank and it remained their go-to “safe house.”

Decades later, after experiencing cataclysmic shifts in the economy during the early 1990s recession when 1,600 banks failed and again during The Great Recession from 2007-2014, when the sub-prime market collapsed and 523 banks failed, many people became suspicious of the traditional methods of “saving” your money in a bank.

Why Many Lost Faith in the Banking System

Once the illusion of trustworthy bankers, like George Bailey in "It's a Wonderful Life”, was demolished, many people had a change of heart. Now, they began to look for ways to “save” their money from the undue risk undertaken by unscrupulous, inept and unknown bankers who behaved like drunken sailors while throwing their hard-earned money around as though it were toilet paper. It became obvious that this new generation of banksters were totally unqualified for their jobs, and worse yet, they didn’t seem to care what happened to the money they were entrusted with.

As a result, many people sought other alternatives. And this is when buying physical silver made a resurgence. It was solid, it was easily acquired and it was severely undervalued, which allowed for a good return of their “investment”.

A Symbol of Stability and Strength

As Chris’ new coin, Safe in Silver, reflects, owning physical silver makes people feel safe because it IS safe. More importantly, it eradicates all of the risks associated with the traditional “digital illusions of wealth’’ because it will never be worthless.

You can see it, smell it, taste it if you like and hold it in your hands. It is fungible, its liquid, it's a hedge against inflation, its market uses are skyrocketing and it protects your money from volatile market fluctuations. Plus, especially when it relates to Chris’ coins, it's beautiful.

Physical silver is the most sensible way to save for the future and create generational wealth.

Enjoy the peace of mind that comes with being Safe in Silver!

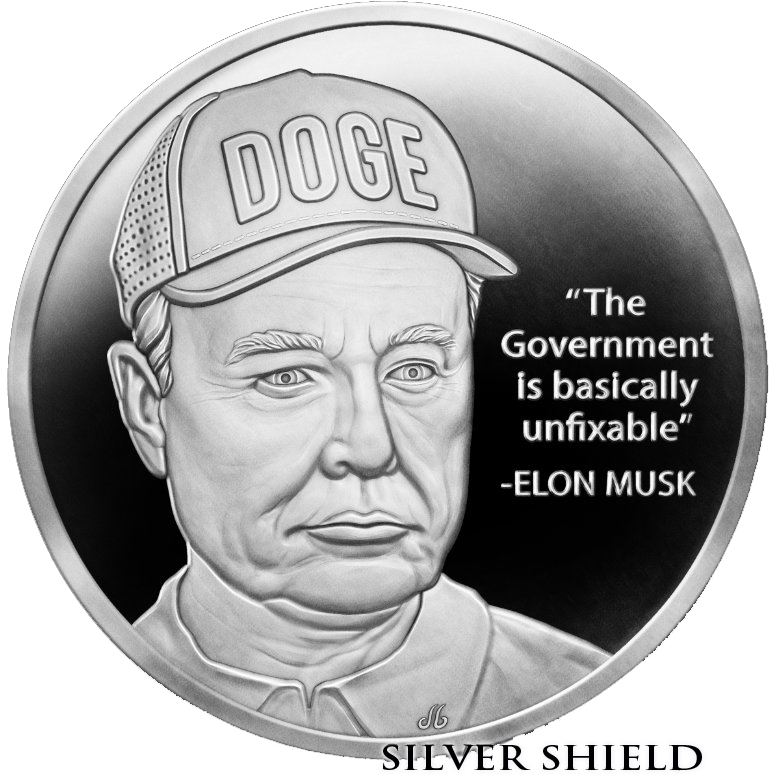

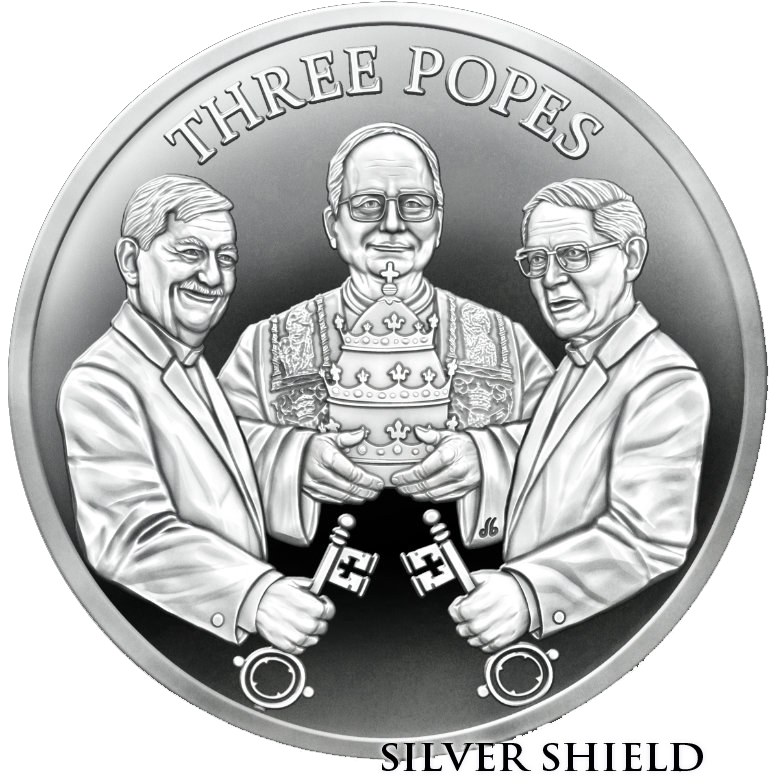

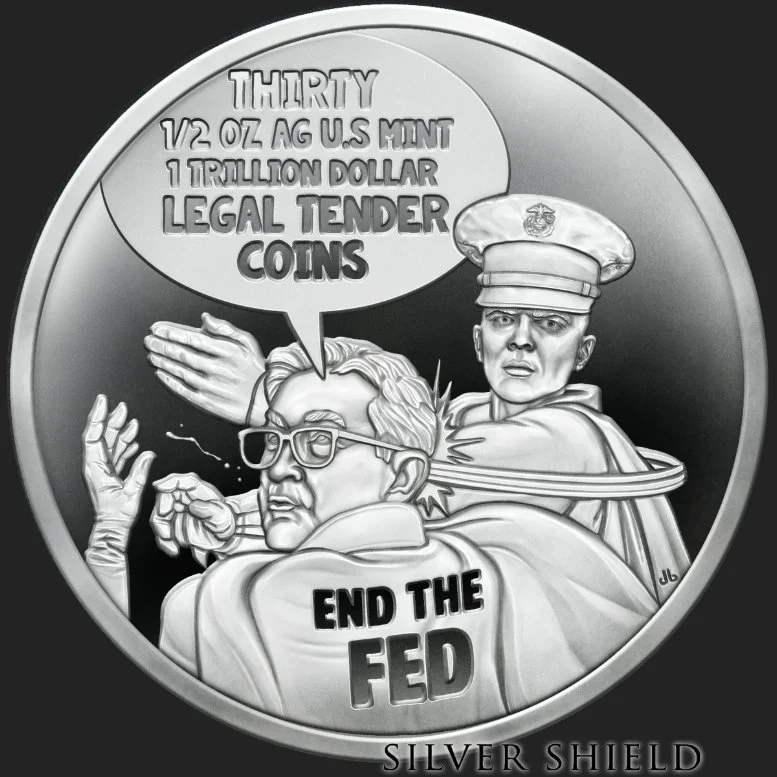

Other 2025 Silver Shield Proof Round releases